ABM Corporation’s Balance Sheet Analysis

Case Study: ABM Corporation\\\’s Balance Sheet Analysis

ABM Corporation is a multinational conglomerate operating in various industries such as technology, healthcare, and energy. As the financial manager of the company, you are tasked with conducting an in-depth analysis of the balance sheet to make strategic decisions.

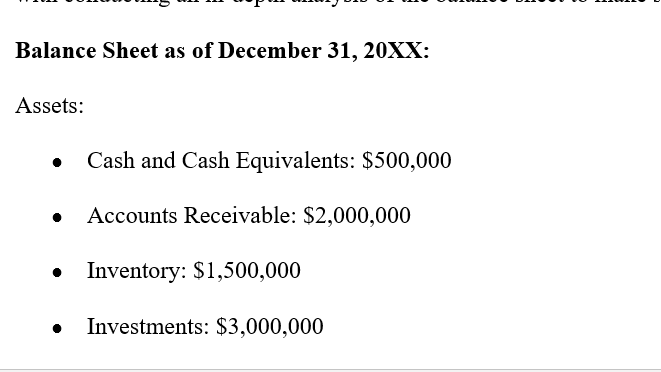

Balance Sheet as of December 31, 20XX:

Assets:

- Cash and Cash Equivalents: $500,000

- Accounts Receivable: $2,000,000

- Inventory: $1,500,000

- Investments: $3,000,000

- Property, Plant, and Equipment: $10,000,000

- Intangible Assets: $5,000,000

- Total Assets: $22,000,000

Liabilities:

- Accounts Payable: $1,500,000

- Short-Term Debt: $1,000,000

- Long-Term Debt: $6,000,000

- Total Liabilities: $8,500,000

Equity:

- Common Stock: $4,000,000

- Retained Earnings: $9,500,000

- Total Equity: $13,500,000

Based on the information provided in the balance sheet, please download the Balance Sheet Analysis Template Download Balance Sheet Analysis Template and use it to answer the following questions. Show your work, including all calculations, and explain your answers in detail. This assignment should take approximately 1 hour to complete.

- Calculate the equity ratio for ABC Corporation and interpret its meaning.

- Which asset category holds the largest proportion? What does it mean when a company holds the largest proportion of its assets in this category?

- Calculate the debt-to-equity ratio for ABC Corporation and interpret the result in terms of the company\\\’s financial risk.

- Analyze the liquidity position of ABC Corporation using the provided data. Which component of current assets contributes the most to its liquidity?

Requirements: no limit

Order Material(s)

Completed File(s)

Answer preview to ABM Corporation’s Balance Sheet Analysis

APA

808 words