The payback period for a project is the number of years needed for a project’s future profits to pay back the project’s initial investment

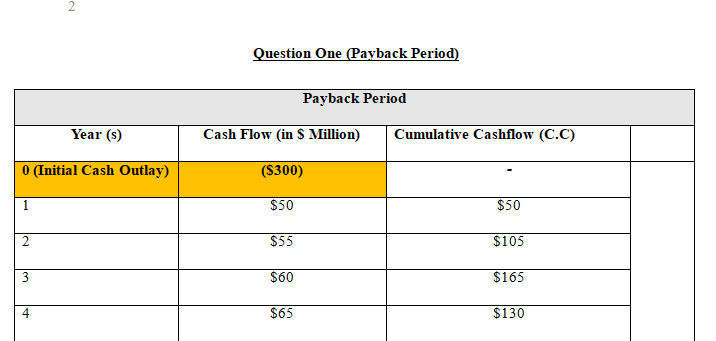

1) The payback period for a project is the number of years needed for a project’s future profits to pay back the project’s initial investment. A project requires a $300 million investment at Time 0. The project yields profit for 10 years, and Time 1 cash flow will be between $30 million and $100 million. Annual cash flow growth will be from 5 percent through 25 percent a year. How does the project payback depend on the Year 1 cash flow and cash flow growth rates?

2) You are thinking of opening a restaurant that will have six four-person tables. Each day that the restaurant is open, there are two lunch seatings and three dinner seatings.

a. The restaurant will be closed on Monday.

b. The average lunch check is $20 and you earn a 40 percent profit margin on lunch checks.

c. The average dinner check is $40 and you earn a 50 percent profit margin on dinner checks.

d. Assume the fixed cost of running a restaurant is $400,000 per year.

Assuming 364 days in a year, use a data table to show how annual profit changes as percentage of seats filled at each meal varies between 10 percent and 100 percent.

Resources:

– Payback Period: https://xplaind.com/849768/payback-period

– Data Table in Excel: https://www.wallstreetmojo.com/data-table-in-excel/

Requirements: Show annual profit changes as percentage of seats filled at each meal varies between 10 percent and 100 percent.

Answer preview to The payback period for a project is the number of years needed for a project’s future profits to pay back the project’s initial investment

APA

763 words