Risk and Return

Please complete the attached assignment after you watch the Finance Lecture – Risk, Return and CAPM by Brad Simon

Question 1: According to the video, how do we define risk?

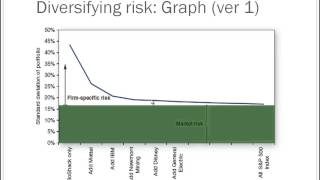

Question 2: According to the video, how would the risk of a portfolio consisting of stocks from a variety of economic sectors compare to one consisting of stocks from just one sector? What is the technical finance term for this concept?

Question 3: According to the video, what is the difference between std. dev. and beta in terms of measuring risk?

Question 4: According to the video, what are some caveats associated with CAPM?

Question 5: According to the video, what is the difference between systematic and unsystematic risk? How is each type of risk impacted by holding a well-diversified portfolio?

Preview YouTube video Finance Lecture – Risk, Return and CAPM

……………………..Answer preview……………………….

In investment, we all expect the best return in that what we have invested must be at a position of yielding more than we expected. Therefore risk is the ability to differ from what we expected as the end result.

According to Campbell (1996). It is noticed that higher risks must come with higher returns in that to have more we must as well invest more. Due to this, the assets are grouped into portfolios this is aimed at reducing the volatility of a given level……………………..

APA

382 words