Create adjusting journal entries at the end of the year (December 31) based on the following adjustment data:

You will create this assignment following the Assignment Detail instructions below.

Review the tutorial How to Submit an Individual Project.

You will have an Excel file for this assignment.

Assignment Details

Using the data provided, perform the steps below to complete the final project.

On December 1, 2019, SoccerBox Inc. started operations. The following transactions occurred during December 2019.

NOTE: There are no beginning balances-this is a new company.

Dec 1

Randol Espy invested $80,000 cash in the company for common stock.

2

SoccerBox purchased soccer equipment for $20,000 cash.

2

SoccerBox rented an old warehouse for $30,000 cash for the first year’s (December 2019-November 2020) rent.

3

SoccerBox purchased $500 of office supplies with cash.

10

SoccerBox paid $12,000 cash for an annual insurance policy.

14

SoccerBox paid $4,000 cash for the first payroll earned by its employees.

24

SoccerBox received $85,000 cash from soccer fees paid by parents for a private youth soccer lesson.

28

SoccerBox paid $4,000 cash for 2 weeks’ salaries earned by its employees.

29

SoccerBox paid $200 cash for minor repairs to its soccer equipment.

30

SoccerBox paid $150 cash for this month’s telephone bill.

30

Dividends of $1,000 cash were paid by SoccerBox to its current shareholders.

Using this spreadsheet and the information above, complete the following:

Record the journal entries that occurred during the month of December.

Prepare an unadjusted trial balance.

Create adjusting journal entries at the end of the year (December 31) based on the following adjustment data:

One month’s insurance coverage has expired (refer to the December 10 entry).

The company occupied the warehouse space for the month of December (refer to the December 2 entry).

At the end of the month, $100 worth of office supplies are still available (refer to the December 3 entry).

This month’s depreciation on the soccer equipment is $250.

Employees earned $300 of unpaid and unrecorded salaries as of month-end.

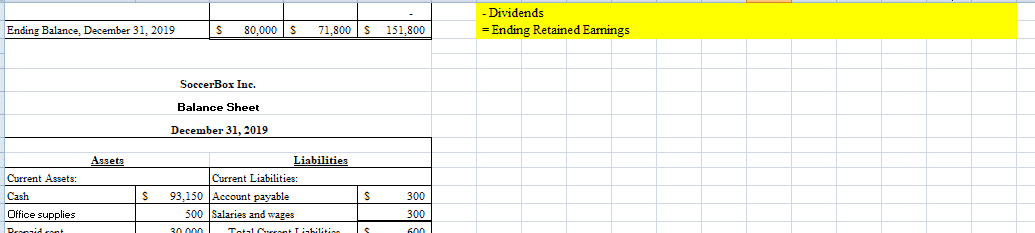

Prepare an adjusted trial balance.

Prepare an income statement, a statement of retained earnings, and a classified balance sheet as of December 31, 2019.

If you are planning to repurpose an assignment or submit one you have used before, please let your instructor know. If an instructor is not made aware of work being repurposed or reused, he or she will treat the assignment as a plagiarized task and reserves the right to post an F grade and submit a task for review to administration until proof of originality is provided. Click here for more information.

The following are some tips if you have problems submitting your assignment:

Resave in the proper format per the Assignment Detail instructions, and resubmit.

Submit with a different Web browser.

Submit from a different computer.

Call Technical Support at 877-221-5800, Menu Option 2. They are open 24/7.

If you are still having difficulties after trying steps 1–4, please contact your course instructor.

Make sure you submit this assignment by the listed due date. Late deductions will apply for this assignment as follows:

Assignments submitted within 7 calendar days after the stated due date: 10% penalty of total assignment points.

Assignments submitted 8–14 calendar days after the stated due date: 20% penalty of total assignment points.

Assignments submitted 15–21 calendar days after the stated due date: 30% penalty of total assignment points.

Assignments submitted 22–28 calendar days after the stated due date: 40% penalty of total assignment points.

No assignments, including late assignments, will be accepted after the end of the course unless an approved Incomplete has been granted.

ACCT205 U4 IP Template Spreadsheet