Financial statements

In the United States, publicly traded companies report their Financial statements based on recognized accounting principles (GAAP). These principles provide consistency in financial reports across companies but are based on accrual accounting rather than cash accounting. Thus, when analyzing historical financial statements, analysts must understand how cash flows appear within the financial statements, and they must define and calculate the historical cash flows. Once analysts understand the historical trends in cash flows, they can evaluate projected cash flows for a business or capital budgeting project.

Write

In your initial discussion forum post,

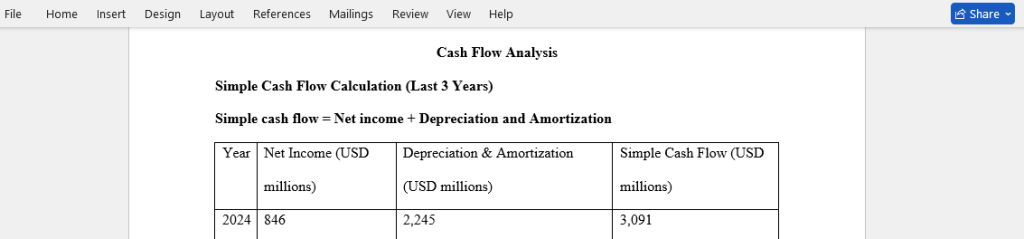

- Using your assigned company, calculate the simple cash flow for the last 3 years.

- Explain how income taxes are reflected in your simple cash flow calculation.

- Using your assigned company, create a table that shows the operating, investing, and financing cash flows for the last 3 years.

- Using your assigned company and your table, describe the trend in operating, investing, and financing cash flows for the last 3 years.

- Explain this statement: Depreciation provides a tax shield on income.

- Explain this statement: If the corporate income tax rate decreases, the value of the depreciation tax shield goes down.

- Explain the principles used to define incremental, after-tax cash flows for budgeting purposes.

- Ask at least one question about cash flow analysis.

Requirements: clear

Answer preview to Financial statements

APA

300 WORDS