Essentials of Finance

Prior to beginning work on this discussion forum,

- Read Chapter 7 in the Essentials of Finance (2nd ed.) textbook.

- Review the project cash flow problems (attached) guide to identify the problem assigned to you, according to your last name.

Reflect

The phrase \\”cash flow\\” has important connotations in finance and in real life. Defining cash flow for specific purposes, including obtaining bank loans, determining credit risk, and valuing capital investments, is the foundation of strong analysis. For purposes of this discussion, and consistent with the textbook, consider the following definitions and formulas for projected cash flow:

| Term | Definition | Timing | Formula |

|---|---|---|---|

| Operating cash flow* | Cash flow net of all operating costs | Annual | After-tax net income + depreciation – changes in net working capital |

| Simple cash flow* | A rough estimate of operating cash flow | Annual | After-tax net income + depreciation |

*Note that, contrary to historical operating cash flow that appears on a company’s statement of cash flows, in projections, it is common to define projected cash flow based on after-tax net income as excluding interest expense. Section 7.2 Financing Costs in the textbook briefly explains this principle.

In addition, there are other categories of cash flow that occur only at specific times (rather than on an annual basis). For purposes of this discussion, and consistent with the textbook, consider the following definitions and formulas for specific cash flow items:

| Term | Definition | Timing | Formula |

|---|---|---|---|

| Initial Investment | Cash spent on initial costs of a project | Once at the start of the project | + New equipment or facilities + installation costs + initial marketing + training + working capital at start of project |

| Terminal Cash Flow, Project End | Cash flow generated or spent at end of project with a finite end date | Once, at end of project | + Salvage Value + Recovery of Working Capital – Cleanup or Reclamation Costs |

| Salvage Value* | Salvage Value*: Cash earned from selling used equipment at end of project with a finite end date | Once, at end of project | + After-tax cash generated from sale of used equipment |

| Recovery of Working Capital* | Recovery of Working Capital*: Cash flow earned liquidating any inventory and collecting all outstanding receivables at end of project with a finite end date | Once, at end of project | + cash from sale of inventory + cash from accounts receivable – cash paid on all remaining accounts payable |

| Cleanup or Reclamation* | Cleanup or Reclamation*: Cash used to shut down plant or facility to prepare for sale at end of project with a finite end date | Once, at end of project | – cash paid for facility cleanup costs, net of taxes – cash paid for environmental remediation (if any), net of taxes |

| Terminal Cash Flow: Ongoing Business* | Present value of free cash flow for a project with no specific end date | Once, at end of project, for projects with no specific end date | = Free cash flow / (r – g) where r = the discount rate g = the long-term growth rate |

Write

In your initial discussion forum post,

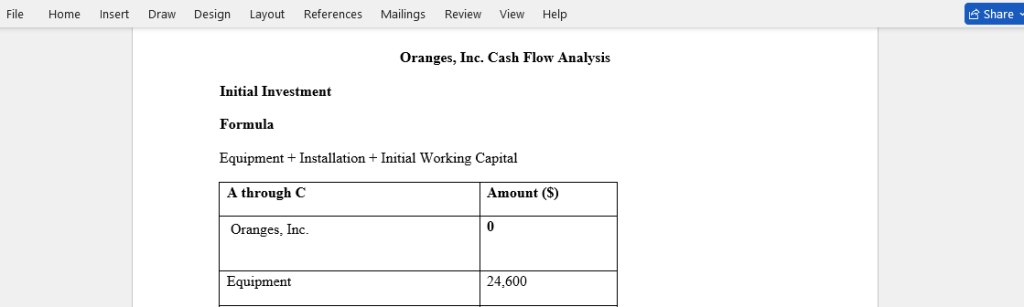

- Calculate the following for the problem you are assigned in project cash flow problems (attached) guide

- Initial investment

- Operating cash flow for years 1 through 5.

- Provide a table with your calculations for the assigned problem.

- Explain this statement: Simple cash flow is typically higher than operating cash flow.

- Explain this statement: For a project that is expected to end after 7 years, the salvage value and cleanup costs would be reflected in the forecast in year 7 only.

- Ask at least one question about projecting cash flows.

Requirements: clear

Answer preview to Essentials of Finance

APA

300 WORDS