How would the risk of a portfolio consisting of stocks from a variety of economic sectors

Watch this videos https://www.youtube.com/watch?v=3BIIiUyr3-w&list=PLLjxc2-pv6iBgj0srApq08U6NAi4bjeTo&index=6

Answer these QUESTIONS below: (BASE ON THE VIDEO, NO OTHER SOURCES)

Risk and Return Assignment

Question 1: According to the video, how do we define risk?

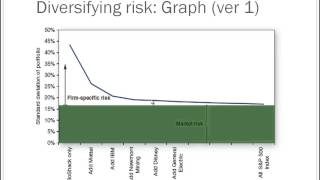

Question 2: According to the video, how would the risk of a portfolio consisting of stocks from a variety of economic sectors compare to one consisting of stocks from just one sector? What is the technical finance term for this concept?

Question 3: According to the video, what is the difference between std. dev. and beta in terms of measuring risk?

Question 4: According to the video, what are some caveats associated with CAPM?

Question 5: According to the video, what is the difference between systematic and unsystematic risk? How is each type of risk impacted by holding a well-diversified portfolio?

(450 WORDS)

NOTE: you just need answer these questions base on the videos (the link), please don’t use other source. Watch the video to the end.

Answer preview to how would the risk of a portfolio consisting of stocks from a variety of economic sectors

APA

580 Words