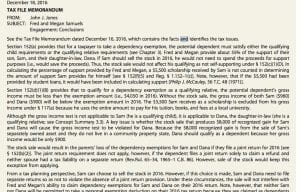

Write a tax memorandum for this research problem which should include sections for facts

Write a tax memorandum for this research problem which should include sections for facts, issues, an analysis and a conclusion. It is due on week 6. Review Chapter 2 prior to preparing the memorandum, specifically the examples on pages 2-30/31.the research paper should follow

1.facts

2. issue: that doing the research on

3. do the research on the cause, find some laws and regulation or cause relate to the research cause You may do your research by using RIA Checkpoint, Commerce Clear House (CCH) and/or Lexis-Nexis.

4. analysis: how do you apply the fact to the law

there is an example on the chapter 2 page 30-31the research problem is

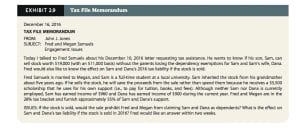

Research Problem 1. Murray reported to the Environmental Protection Agency that his employer was illegally dumping chemicals into a river. His charges were true, and Murray’s employer was fined. In retaliation, Murray’s employer fired him and made deliberate efforts to prevent Murray from obtaining other employment. Murray sued the employer, claiming that his reputation had been damaged. Murray won his lawsuit and received an award for “damages to his personal and professional reputation and for his mental suffering.” Now he would like to know whether the award is taxable. He argues that he was awarded damages as a recovery of his human capital and that a recovery of capital is not income. Therefore, the Federal government does not have the power to tax the award.a little help for the research problem

In Murphy v. the United States, 493 F.3d 170 (CA–DC, 2007), the appellate court noted that while the Sixteenth Amendment to the Constitution grants Congress the power to tax income, the Federal government is not limited to taxing only income. Thus, based on a long line of Court decisions, the Federal government has the right to tax a variety of transactions. Congress has indicated in § 104 that it intended to tax nonphysical personal injury awards. Thus, Murphy’s award was taxable. The same result holds true for Murray.

Answer preview to Write a tax memorandum for this research problem which should include sections for facts