At the end of the Class portion of this lesson, we began to study the effects of making minimum payments on credit card debt.

2-5 Technology (p. 123 in your eBook)

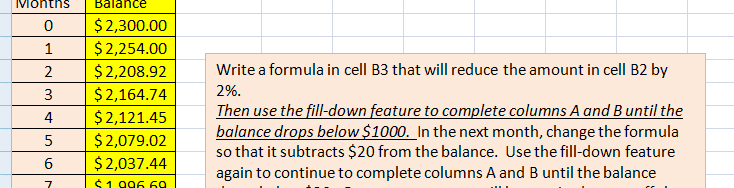

At the end of the Class portion of this lesson, we began to study the effects of making minimum payments on credit card debt. We can set up a spreadsheet to help calculate how long it would take to pay down the $2,300 debt. The key is to recognize that if 2% of the debt is paid every month, then the new balance is 98% of the previous balance. This allows you to set up a formula that calculates 98% of the previous balance. Also, the bank requires that the minimum payment each month is not less than $20, so once the balance gets below $1,000, the monthly payment will be $20 per month. At that point, change your formula so that it subtracts $20 from the previous balance. Use your spreadsheet to find how long it takes to pay off the balance, in months and in years. A template to help you get started can be found in the online resources for this lesson.

Note, you will see the formula typed in the formula bar above the cell columns.

Note, the attached PDF will show you how to access the eBook where you can access the video for the DQ.

1. Click Unit 2

2. Choose media

3. Scroll to the right until you find QR 2-5 Tech video.

Here is the link for Tech Video QR 2 – 5

http://bit.ly/39BVOjL