Calculate the annual payment on a loan using the present value of an annuity.

Textbook: Introduction to Finance: Markets, Investments, and Financial Management, Enhanced eText, 17th Edition Instructions

For this assignment, you will complete the Unit IV Assignment Worksheet.

This assignment will allow you to demonstrate what you have learned in this unit.

Access the Unit IV Assignment Worksheet in Blackboard to complete this assignment. Save all of your work directly to the template, and submit it in Blackboard for grading.

This assignment will allow you to demonstrate the following objectives:

• Calculate the annual payment on a loan using the present value of an annuity.

• Use discounting to determine the present value of an annuity.

• Calculate the future value of an annuity and periodic annuity payments.

• Determine the present value of a bond.

Instructions: Answer the questions directly on this document. When you are finished, select “Save As,” and save the document using this format: Student ID_UnitIV. Upload this document to BlackBoard as a .doc, docx, or .rtf file. Show all of your work.

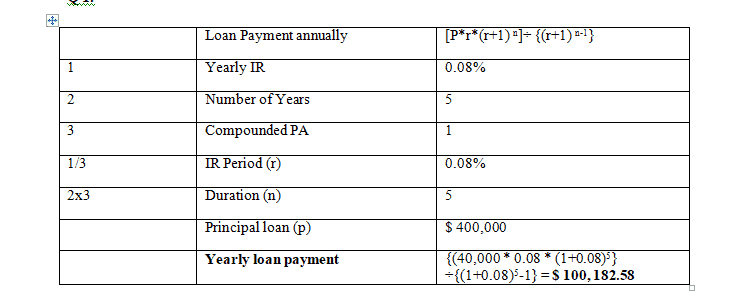

1. Your supervisor has tasked you with evaluating several loans related to a new expansion project. Using the PVIFA table (table 9.4 in the textbook), determine the annual payment on a $400,000, 8% business loan from a commercial bank that is to be amortized over a five-year period. Show your work. Does this payment seem reasonable? Explain.

2. Dan is considering borrowing $500,000 to purchase a new condo. Based on that information, answer the following questions. Show all work.

a) Calculate the monthly payment needed to amortize an 8% fixed-rate 30-year mortgage loan.

b) Calculate the monthly amortization payment if the loan in (a.) was for 15 years instead.

c) In a few sentences, explain the effect of a smaller loan period. How does it influence the monthly payment and interest?

Answer preview to calculate the annual payment on a loan using the present value of an annuity.

APA

631 words